A company is dormant in a financial year if the company does not carry on business and there is no accounting transaction occurred. Its total assets in the current Statement.

Audit Exemption In Malaysia How To Qualify For It

Assuming that the financial year-end is on 31 December every year.

. From 1st January 2016 until today Company A has not conducted any business activity. 32017 on the Qualifying Criteria for Audit Exemption for Certain Categories of Private Companies Practice Directive. Assuming that the financial year end is at 31 December every year.

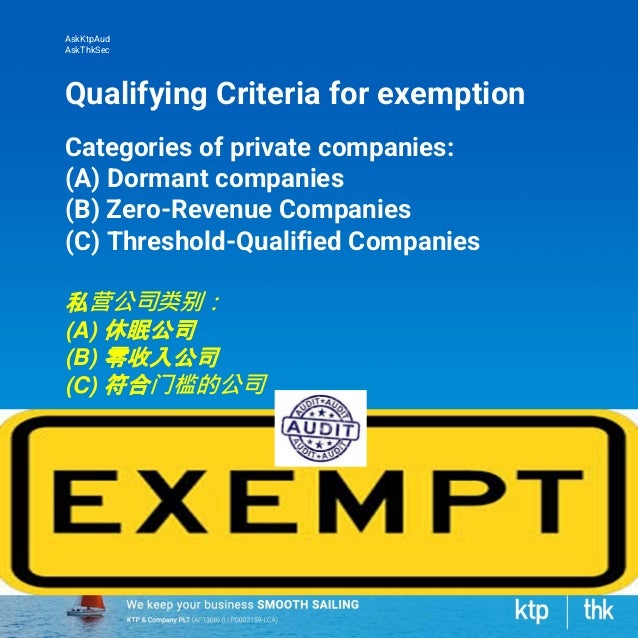

Zero-revenue companies are eligible for audit exemption if they generate no revenue during the current financial year they generated no revenue in the two financial years prior and their current. What is the threshold for company audit exemption. 32017 to set out the qualifying criteria for private companies to be exempted from appointing an auditor for a financial year.

2 Company B was incorporated on 1st January 2015. On 4 August 2017 the Companies Commission of Malaysia SSM brought into action audit exemption for certain categories of private companies. AUDIT EXEMPTION Note 6 QUALIFY FOR AUDIT EXEMPTION Note 6 Criteria for Exemption Additional Requirement NO NO NO NO NO NO YES YES YES YES YES YES NOTE 1 Para.

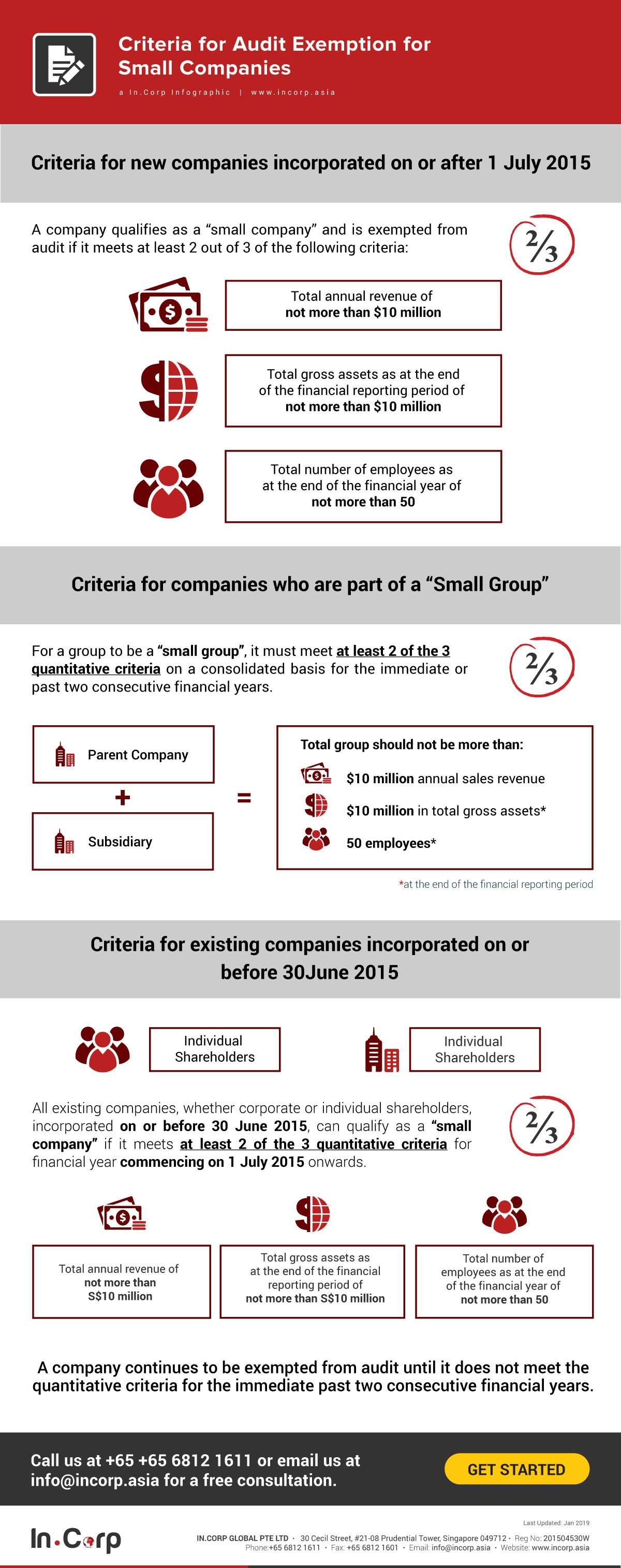

A threshold-qualified company is a private entity as defined by the MASB and is qualified for an audit exemption if. All companies incorporated in Malaysia must have their accounts audited by a Ministry of Finance approved auditor as mandated by the Companies Act of 2016. AskKtpAud AskThkSec 15032022 1 Lodgement with SSM a circulate to members within 6 months from financial year end S258 1a of Companies Act CA 2016.

Companies that satisfy the criteria set forth shall not be required to appoint an approved auditor to prepare and audit their financial statements before lodging. Company A may apply for audit exemption. 1 AUDIT EXEMPTION FOR SMALL AND MEDIUM ENTERPRISES.

The Companies Commission of Malaysia has issued Practice Directive No. The Companies Act 2016 which came into operation on 31 January 2017 requires all companies to prepare and audit their financial statements before lodging it with the Companies Commission of Malaysia SSM. Audit exemption was influenced by audit benefits and.

Audit Exemption Malaysia - Part 2 1. 3 School of M angem nt Universiti ins M l ysia 11800 P si. A threshold-qualified company is a private entity as defined by the Malaysian Accounting Standards Board MASB and the company is qualified for an audit exemption if.

Written by Gunalan Appalasamy CA M It was proposed that Dormant Companies. It has revenue includes revenue receivable during the year not exceeding RM100000 during the current financial year and in the immediate past two 2 financial years. Company B was incorporated on 1st January 2016.

The criteria for audit exemption for certain private companies are. The Companies Act 2016 CA 2016 requires every private. Audit Exemption For Selected Categories Of Private Companies.

PERCEPTIONS OF MALAYSIAN AUDITORS Hasnah Haron1 Ishak Ismail2 Yuvaraj Ganesan3 and Zulhawati4 12 Faculty of Industrial Management Universiti Malaysia Pahang 26300 Gambang Pahang M al ysi. In line with the qualifying criteria for audit exemption stated accordance to Practice Directive No. This article is based on Proposed Practice Directive 12017 on Audit Exemption issued by CCMSSM on 8 November 2016.

The hypotheses in this study were developed to examine whether the level of acceptance on. How do I file an exemption for an audit. Audit exemption of Malaysia Private Companies Print ready version On 4 August 2017 the Registrar of Companies in Malaysia CCM or the Registrar issued a practice directive setting out the qualifying criteria for private companies incorporated in Malaysia from having to appoint an auditor in a financial year Practice Directive.

AGMs are no. Audit exempt for zero-revenue companies financial statements with annual periods commencing on or after 1 January 2018. However under section 267 2 of the Companies Act 2016 the Registrar of.

What are the limits for exemption in Malaysia. On 4 August 2017 the Companies Commission of Malaysia CCM issued its Practice Directive No. 我的 Sdn Bhd Account 要怎样不需审计 How can I be exempt from audit.

Dormant companies A dormant company is a private entity as defined by the Malaysian Accounting Standards Board MASB and the company is. AskKtpAud AskThkSec 15032022 2. 1 Company A was incorporated on 1st January 2015.

August 14 2017 by Conventus Law. On August 4 2017 the Companies Commission of Malaysia CCM has brought into force audit exemption for certain categories of private companies. Definition of threshold-qualified companies.

Revenue here includes revenue receivable during the year. According to the Companies Act of 2016 companies incorporated in Malaysia are required to have their financial statements audited by an auditor approved by the Ministry of Finance. Company A was incorporated on 1st January 2016.

32017 Company that elects to be exempted from audit shall lodge its unaudited financial statements to Suruhanjaya Syarikat Malaysia SSM together with certificate in compliance with sections 258 and 259 of the Companies Act 2016. On 4 August 2017 the Companies Commission of Malaysia SSM brought into effect audit exemption for certain categories of private companies. Companies opting for audit exemption must provide a complete.

The company is dormant this means the business has no accounting transactions occurring and its operations have. 4Faculty of Information Technology and. Audit Exemption for Private Companies.

An auditor shall not be required to be appointed in order to prepare and audit financial statements if the company fulfil the criteria given. To further reduce the cost of doing business the Companies Commission of Malaysia has announced that dormant zero-revenue and threshold-qualified private companies are eligible to elect for audit exemption. Since 1st January 2015 until today Company A has not conducted any business activity.

A it has revenue not exceeding RM100000 during the current financial year and in the immediate past two 2 financial years. It has revenue not exceeding RM100000 during the current financial year and in the immediate past two 2 financial years. Company A may apply for audit exemption.

In financial year ending 31 December.

Audit Exemption In Malaysia Am I Eligible Quadrant Biz Solutions

Ccm Issues Practice Directive On Audit Exemptions For Private Companies Zico

English Audit Exemption Ssm Pd 3 2017 Disclosure Of Annual Return

How To Qualify For Audit Exemption In Malaysia With Example

Setting Up Practice In Malaysia

Reasons Against Audit Exemption Among Sme Companies In Malaysia Utar Institutional Repository

J K Tan Co Johor Bahru Audit Firm Approved Company Auditor Licensed Tax Agent Sst Sst Seminar Gst Tax Agent Accounting Johor Bahru Chartered Accountants Johor

Pdf The Relationships Between Director Auditor Link And Audit Opinion

Pdf The Provision Of Non Audit Services Audit Fees And Auditor Independence

How To Qualify For Audit Exemption In Malaysia With Example

Ktp Company Plt Audit Tax Accountancy In Johor Bahru

What Are The Criteria For Audit Exemption For Small Company Infographics

Audit Exemption For Private Companies Venture Haven Top Malaysia Accounting Firm

English Audit Exemption Ssm Pd 3 2017 Disclosure Of Annual Return

Pdf Audit Exemption For Small And Medium Enterprise Perceptions Of Malaysian Auditors

Small Companies In Malaysia Do Not Need Auditors Audit Exemption

Qualifying Criteria For Audit Exemption For Malaysia Private Limited Companies

Ccm Issues Practice Directive On Audit Exemptions For Private Companies Zico